risks associated with closed end funds

A lot of the funds in the closed-end fund space use leverage. Ad Delivering Efficient Transparent Market Exposure.

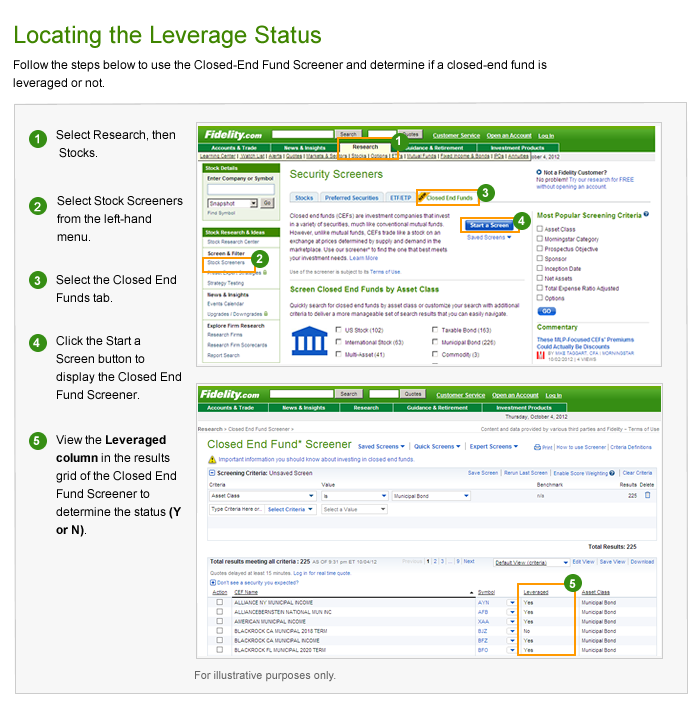

Closed End Fund Leverage Fidelity

CEFs are sometimes described as ancestors to exchange-traded funds but CEFs have a fixed number of shares while ETFs can raise or lower the figure as demand changes.

. And this was typically historically this has typically been from preferred shares or from debt. General Risk Factors Related to Closed-End Funds. The single biggest risk in ETFs is market risk.

Answer Question Share 6 1. Download Fisher Investments free guide The Six Pitfalls of Funds. Expense ratios or the cost of owning the fund each year may also be lower compared to some open-end funds.

Here are ten reasons to consider closed-end funds. Closed-end funds are more likely than open-end funds to include alternative investments in their portfolios such a s futures derivatives or foreign currency. A closed-end funds shares have two sets of values.

The Allspring Income Opportunities Fund is a closed-end high-yield bond fund. This site does not list all of the risks associated with each fund. The Securities and Exchange Commission is worried about significant compliance and risk management issues associated.

Closed-end funds CEFs can be one solution with yields averaging 673. Ad Reduced single fund risk with a portfolio of CEFs managed by top fixed-income managers. Like any investment product closed-end funds offer opportunity but also come with a number of risks some of which are listed below.

Investors should contact a funds sponsor for fund-specific risk information andor contact a financial advisor before investing. Visit iShares Official Site. Directors and managers of closed-end funds beware.

Jeff Rossi President Peak Wealth Advisors JeffRossi 072916 This. Prices may swing from one high value to a low value point all in one days. The risks associated with.

This site does not list all of the risks associated with each fund. Are closed end funds risky. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF.

Like a mutual fund or a closed-end fund ETFs are only an investment vehiclea wrapper for their underlying investment. Current price is what the shares are currently trading for on an exchange. Closed-end funds issue a fixed number of shares through an initial public offering and typically do not.

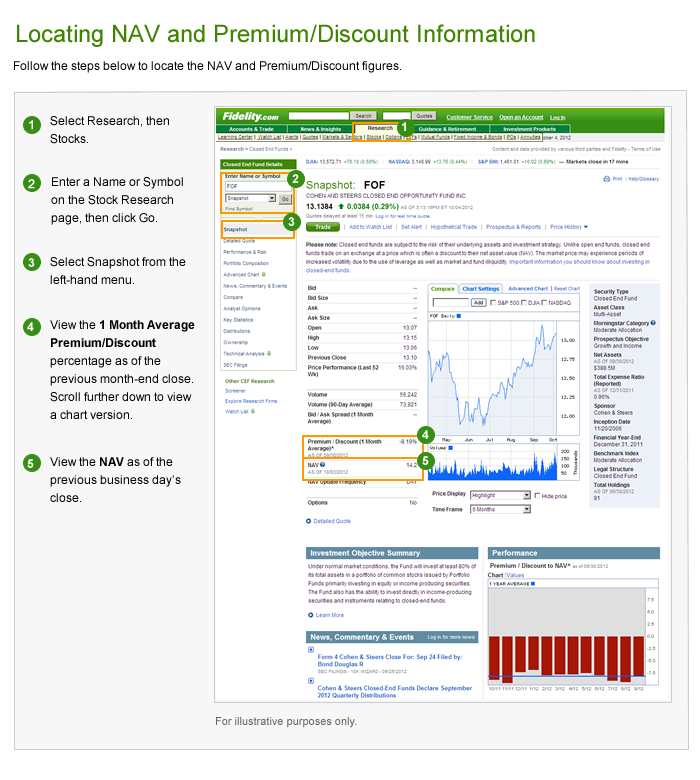

Among the advantages CEFs - unlike open-end mutual funds - trade at a discount or premium to net asset value. A Closed End Fund CEF is an investment company which is listed on an exchange and traded intraday at prices determined by supply and demand in the market. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market.

Diversified by asset strategy manager. This can be a retail product for those who can stomach the associated risks in their search for relatively high-potential income and gains. Closed-end funds can offer advisers.

Current price and net asset value or NAV. The following list of risk factors provides a review of those associated. Ad Does investing in funds give you more control over your 500K in savingsor less.

Any day when theres a 1 move in a CEF can be thought of as a day when there is a supply and demand imbalance outside of ex-dividend days and large moves in interest. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. So if you buy an SP.

Shares of closed end funds in secondary markets are often accompanied by high volatility in trading. Its assets are actively managed by the funds. Risk factors pertaining to closed-end funds vary from fund to fund.

Investors should contact a funds sponsor for fund-specific risk information andor contact a financial advisor before investing. Like a mutual fund a closed-end. Small- and mid-cap securities may be subject to special risks associated with narrower.

At year-end 2021 assets in bond closed-end funds were 186 billion or 60 percent of closed-end fund assets. Answer Question Report Abuse Share. What are the risks associated with Closed-end Funds.

Look for Discounts and Premiums. Lower Expense Ratios - Closed-end. All bond closed-end funds are subject to some degree of market.

Closed-end funds generally do not impose trail commissions or 12b-1 fees which are assessed against the account annually as many mutual funds do. So for instance a CEF.

:max_bytes(150000):strip_icc()/mutual_funds_paper-5bfc2e2c46e0fb00260ba168.jpg)

Trading Mutual Funds For Beginners

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Guide To Closed End Funds Money For The Rest Of Us

What Are Closed End Funds Forbes Advisor

Rr Investors Offers Nfo Uti Capital Protection Oriented Scheme Series Iv I 1103 Days Http Goo Gl Bnxohr Mutuals Funds Investing Fund

Guide To Closed End Funds Money For The Rest Of Us

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Morningstar Investment Research Center Provides Real Time Access To Comprehensive Data And Independent Analysis On Investing Online Resources Research Centre

Understanding Closed End Vs Open End Funds What S The Difference

What Are Mutual Funds 365 Financial Analyst

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Difference Between Open Ended Funds Vs Close Ended Funds

What Are Closed End Funds Fidelity

Closed End Fund Cef Discounts And Premiums Fidelity

Guide To Closed End Funds Money For The Rest Of Us

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

Birla Sun Life Emerging Leaders Fund Series 3 Let Your Ambitions Soar Higher With Us High Potential Discovered Early A Closed E Investing Mutuals Funds Fund

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)