nj property tax relief fund 2020

Beginning with tax year 2020 the Middle Class Tax Rebate will be issued to eligible New Jersey residents that file a 2020 resident Income Tax return NJ-1040 with a balance of tax 1 or more. The rebates will be hitting the mail as soon as July 1 sending 500 to over 750000 New Jersey families.

Tax Assessor Township Of Franklin Nj

For Immediate ReleaseApril 15 2020.

. County and municipal expenses. This inflated and unprecedented growth was anticipated due to the change in state law that allowed individual. Phil Murphys latest budget calls for flat or even reduced state funding for popular property-tax relief programs that provide targeted financial help to thousands of New Jerseys low-income homeowners seniors and people with disabilities.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Fiscal year-to-date total collections of 22398 billion are up 13 billion or 62 percent above the same period last year. Capital gains and the exclusion of all or part of the gain on the sale of a principal residence are calculated in the same manner for.

All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did. Requires additional aid to be subtracted from municipal property tax levy.

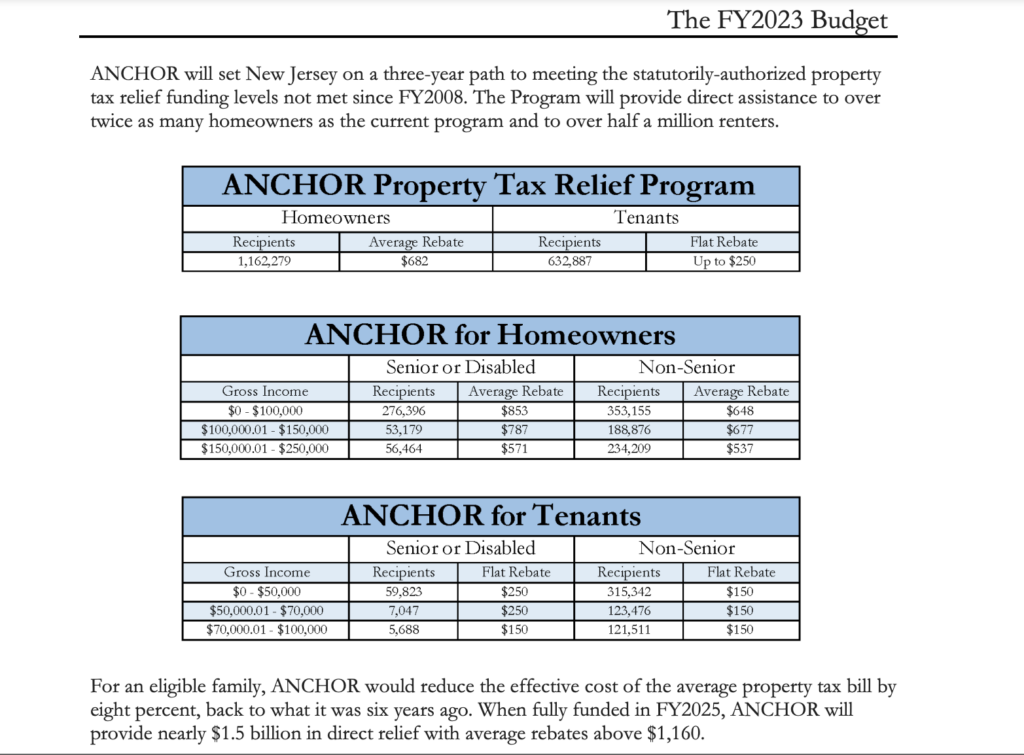

Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. All property tax relief program information provided here is based on current law and is subject to change.

Phil Murphy wants to increase how much the state spends each year on property-tax relief benefits so more New Jersey residents can receive them. Capital gains on the sale of a principal residence of up to 250000 if single and up to 500000 if marriedcivil union couple. TRENTON The Department of the Treasury today reported that July revenue collections for the major taxes totaled 5136 billion up 2802 billion or 1201 percent over last July.

Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. Renters can qualify for like 50 of property tax relief. JOHN REITMEYER SEPTEMBER 6 2020.

New Jersey Income Tax Author. The new property tax relief program announced last week would use 900 million to replace the Homestead Benefit and extend property. Im proud to say that three of the five lowest property tax increase ever on.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Phil Murphy s proposed 324 billion spending plan includes 275 million for the property tax relief program which lowers tax bills. Book A Consultation Today.

Nj Property Tax Relief Program Updates Access Wealth. TRENTON - The Department of the Treasury today reported that March revenue collections for the major taxes totaled 1888 billion up 663 million or 36 percent above last March. NJ Division of Taxation Senior Freeze Property Tax Reimbursement Inquiry.

Check If You Qualify For This Homeowner StimuIus Fast Easy. The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation. February collections for the Gross Income Tax GIT which is dedicated to the Property Tax Relief Fund totaled 1439 billion up 1575 million or 123 percent above last February.

Fiscal year-to-date collections of 10799 billion are up 1517 billion or 163 percent. In New Jersey localities can give. Have a copy of your application available when you call.

Check Your Eligibility Today. So any personal income tax refunds come out of the Property Tax Relief Fund. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019.

NJ Division of Taxation - Local Property Tax Relief Programs. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. Call NJPIES Call Center.

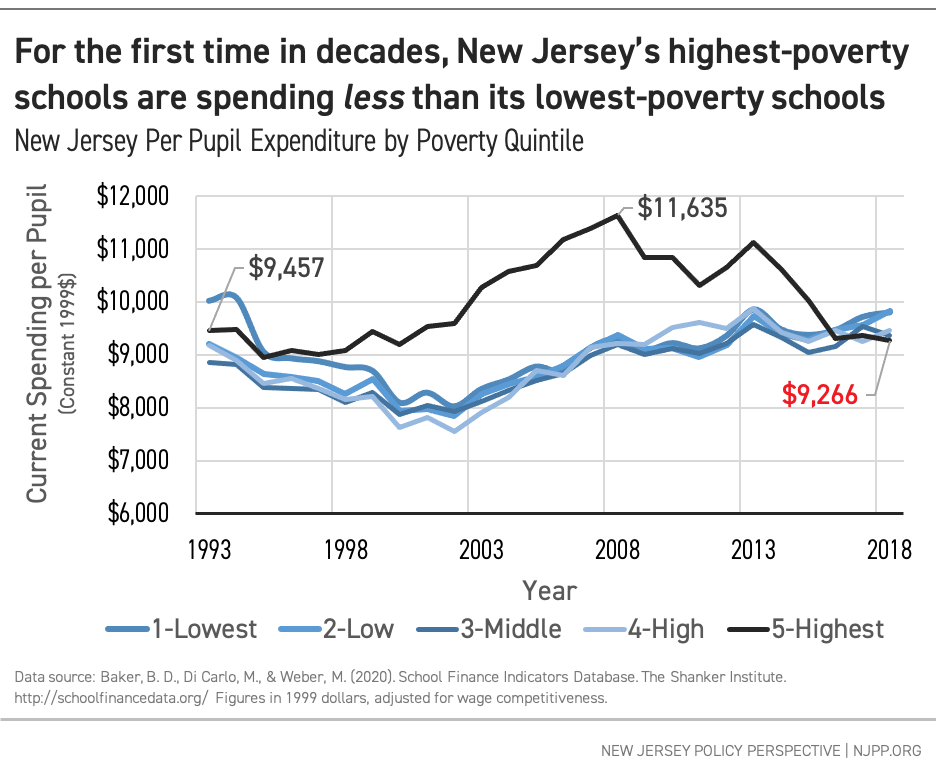

Besides education property taxes in NJ also fund. In New Jersey Murphy in recent years has billed his administrations push to better fund the state-aid formula for K-12 schools as a property-tax relief initiative. Dont Miss Your Chance.

Letter of Ineligibility for Out-of-State Residents Complete Request for a Letter of Property Tax Relief. The main reasons behind the steep rates are high property values and education costs. So any personal income tax refunds come out of the Property Tax Relief Fund.

Forms are sent out by the State in late Februaryearly March. Bill Text 2020-01-14 Increases distribution to municipalities from Energy Tax Receipts Property Tax Relief Fund over five years to restore municipal aid reductions. Property Tax Reimbursement Hotline.

The Homestead Benefit program provides property tax relief to eligible homeowners. 18 of your rent is used to calculate your share of property tax Per the state constitution Article VIII Section I paragraph 7 100 of personal income tax goes to property tax relief. Out of State Residents.

COVID-19 is still active. Increasing state aid is a very inefficient strategy to provide property tax relief for homeowners as a large share of state funding will end up increasing local spending or. Stay up to date on vaccine information.

Deferred April Tax Payments Track Close to Expectations. Beginning with tax year 2020 the Middle Class Tax Rebate will be issued to eligible New Jersey residents that file a 2020 resident Income Tax return NJ-1040 with a balance of tax 1 or more. Capital gains in excess of the allowable exclusion must be included in income.

Mortgage Relief Program is Giving 3708 Back to Homeowners. For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms. Senior Freeze Property Tax Reimbursement Program.

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

State Local Property Tax Collections Per Capita Tax Foundation

Murphy S Property Tax Rebate Proposal Adds Renters Video Nj Spotlight News

Nj Renters In Line For Some Needed Tax Relief Nj Spotlight News

Deducting Property Taxes H R Block

Letter From Mayor Santos Regarding The 3rd And 4th Installment 2019 Tax Bills And The 1st And 2nd Installment 2020 Tax Bills

Florida Property Tax H R Block

N J State Budget Appropriation Process Gets Underway Whyy

Surging Tax Revenues Fuel Murphy S Big Budget Plan Nj Spotlight News

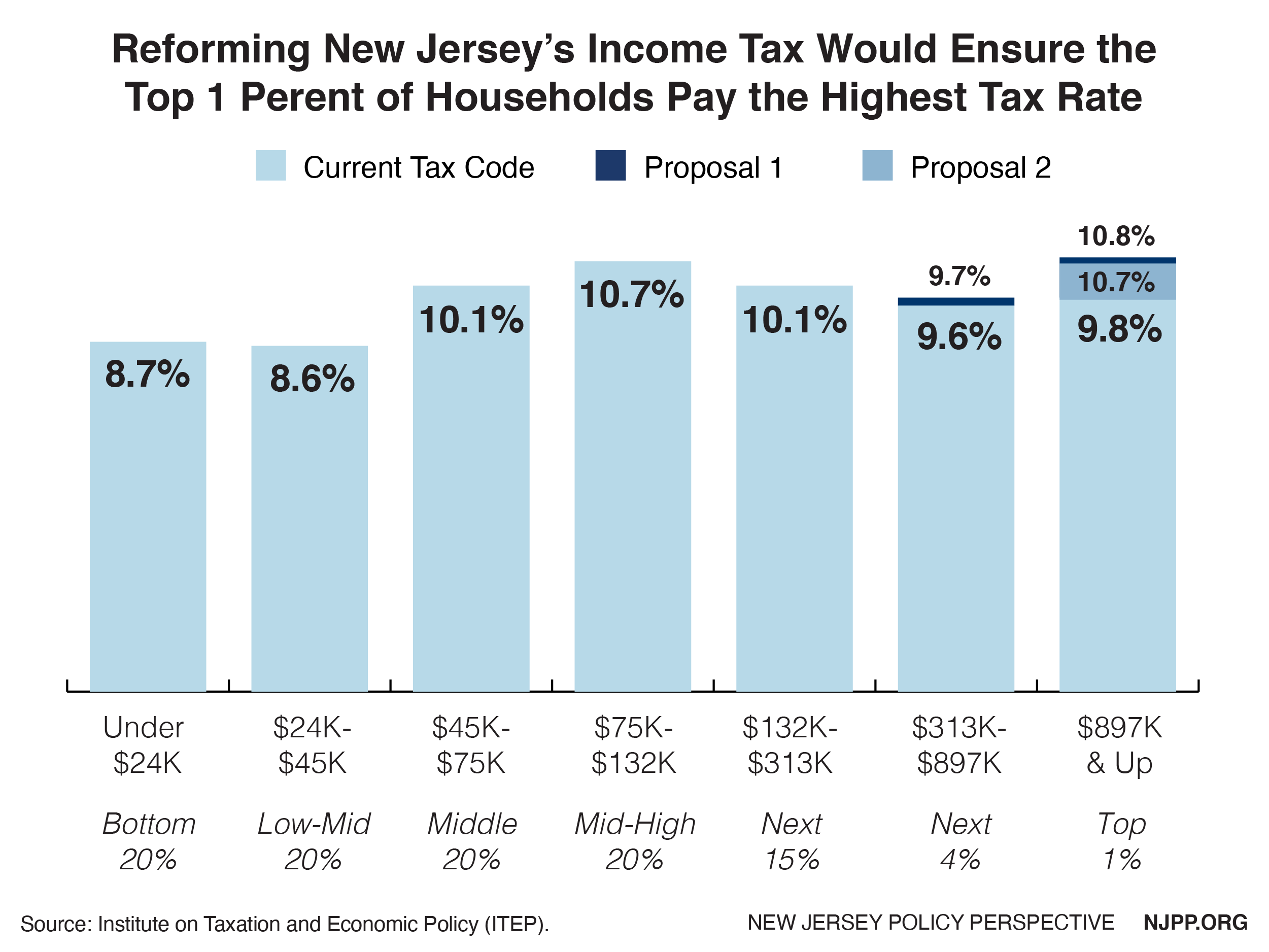

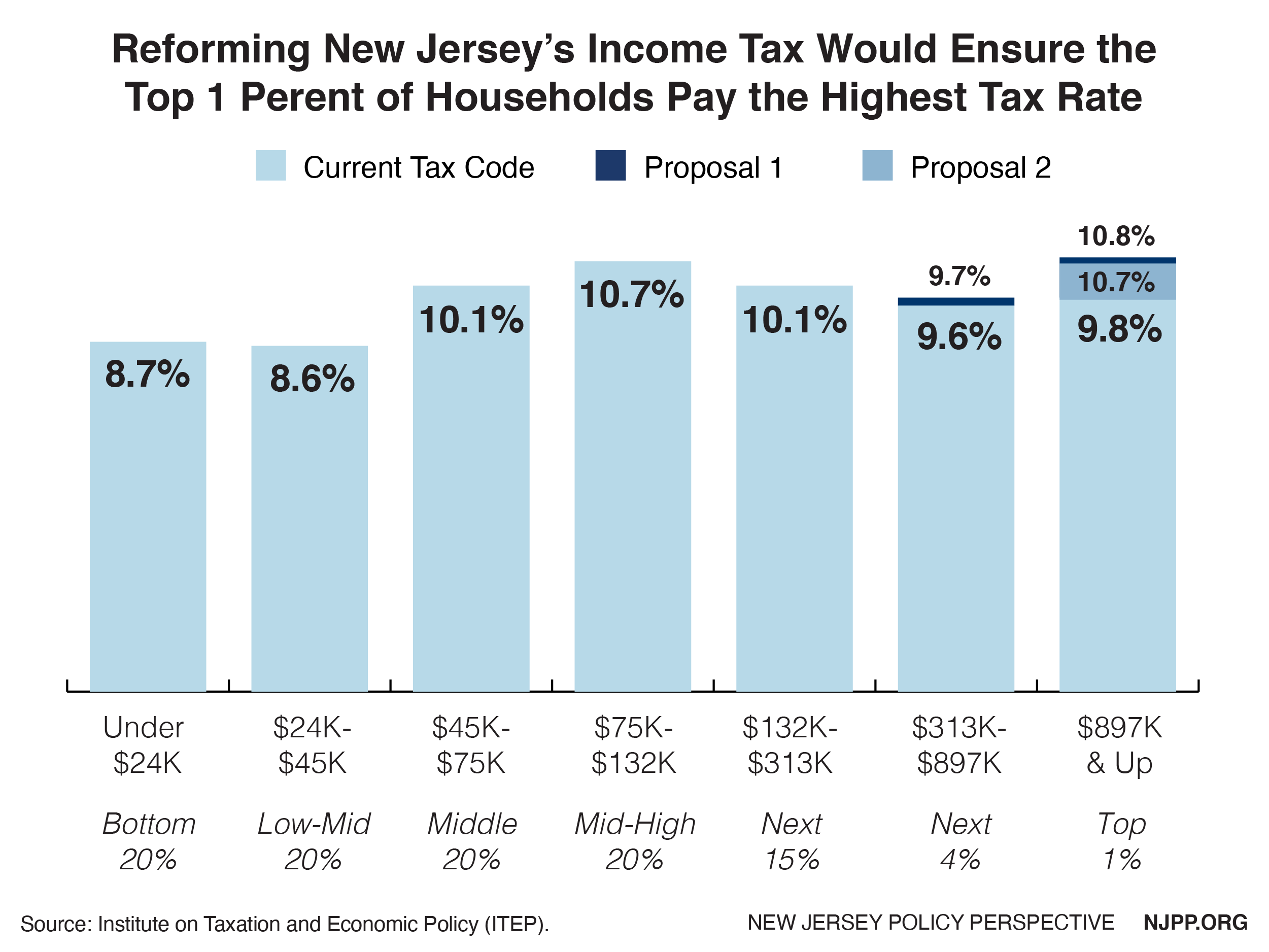

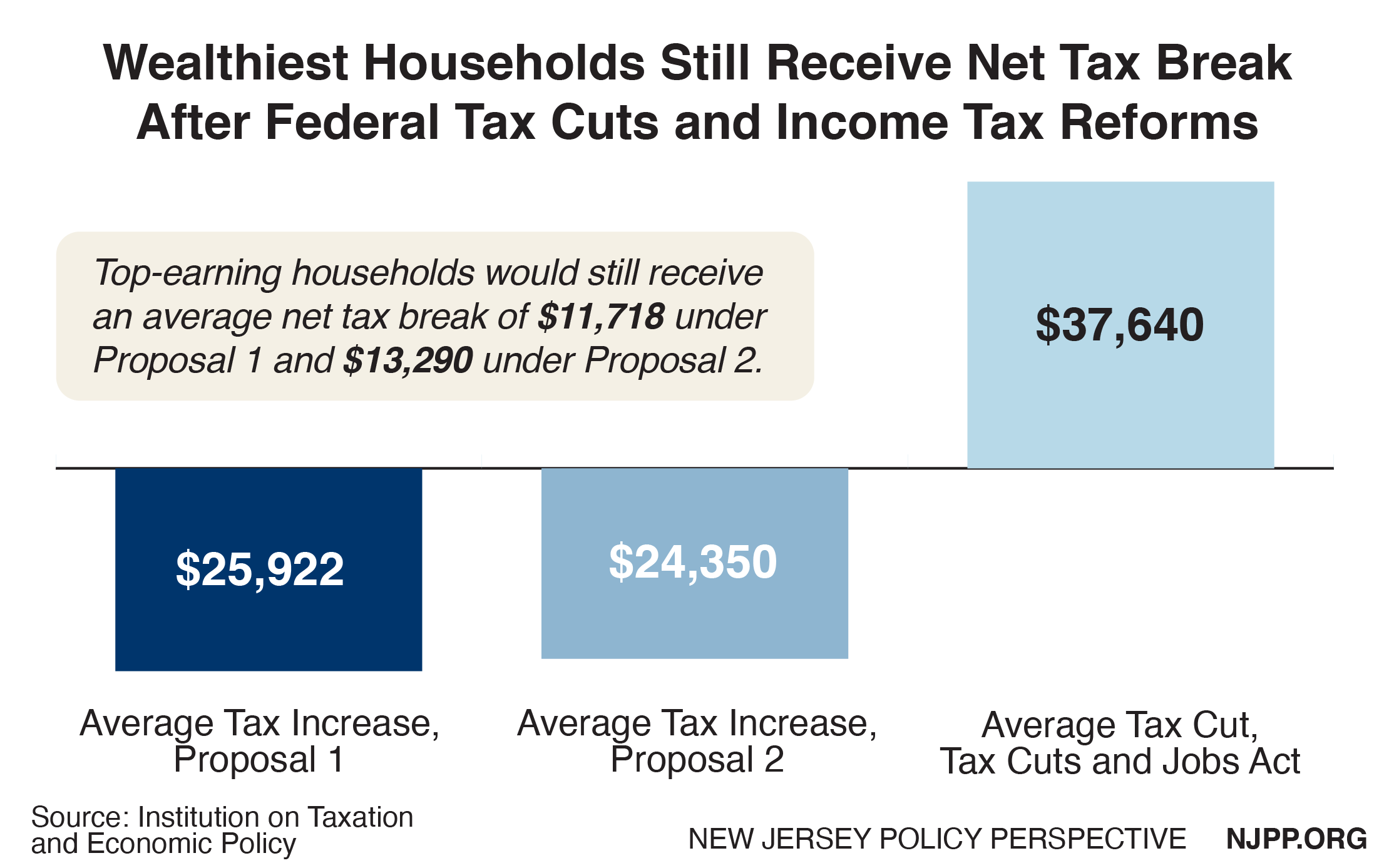

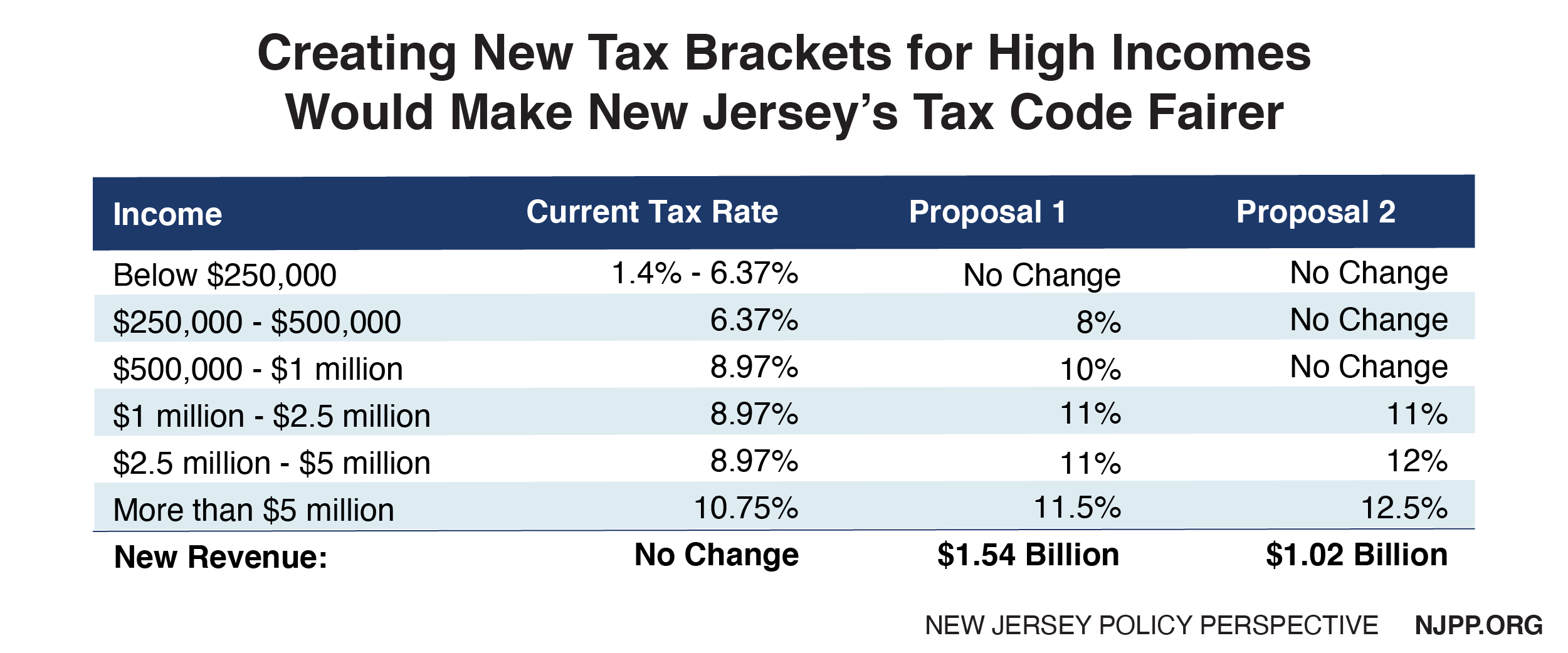

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

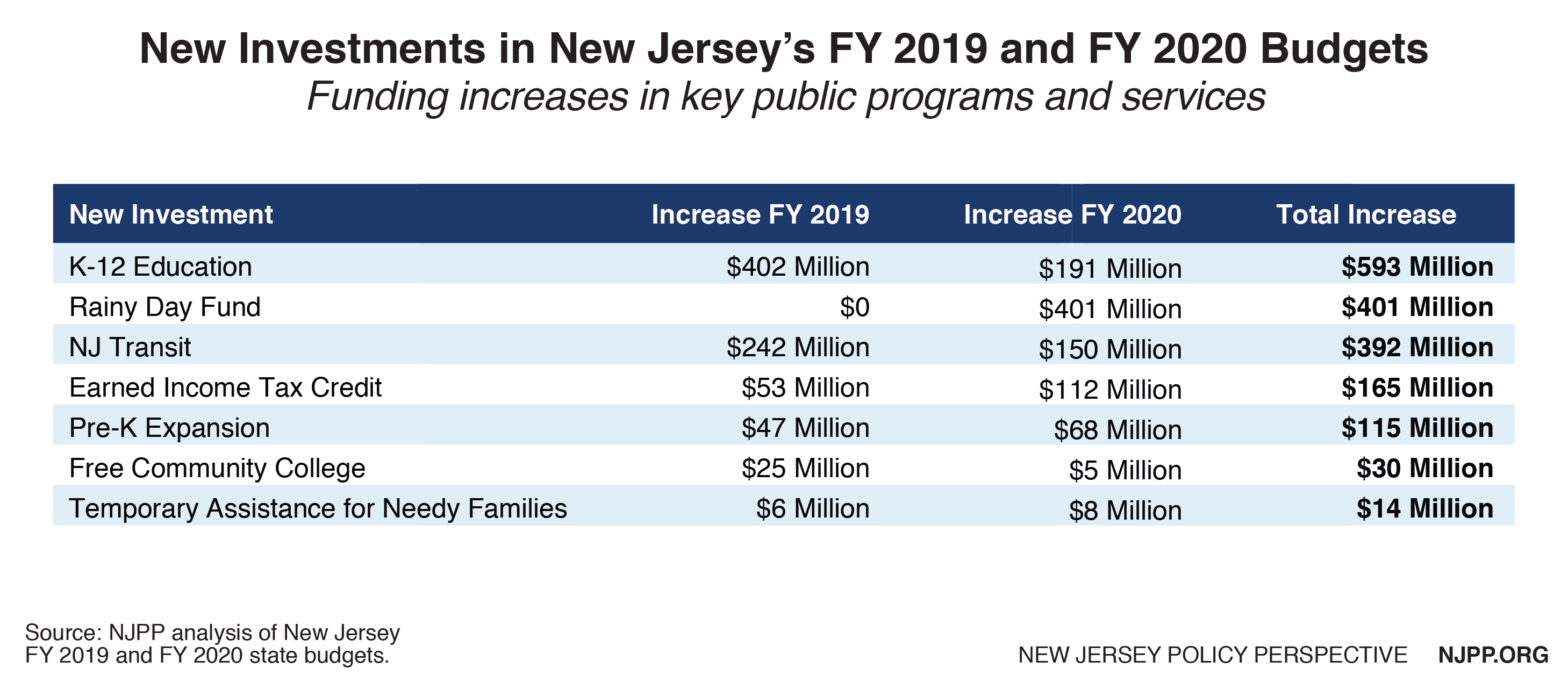

School Funding In New Jersey A Fair Future For All New Jersey Policy Perspective

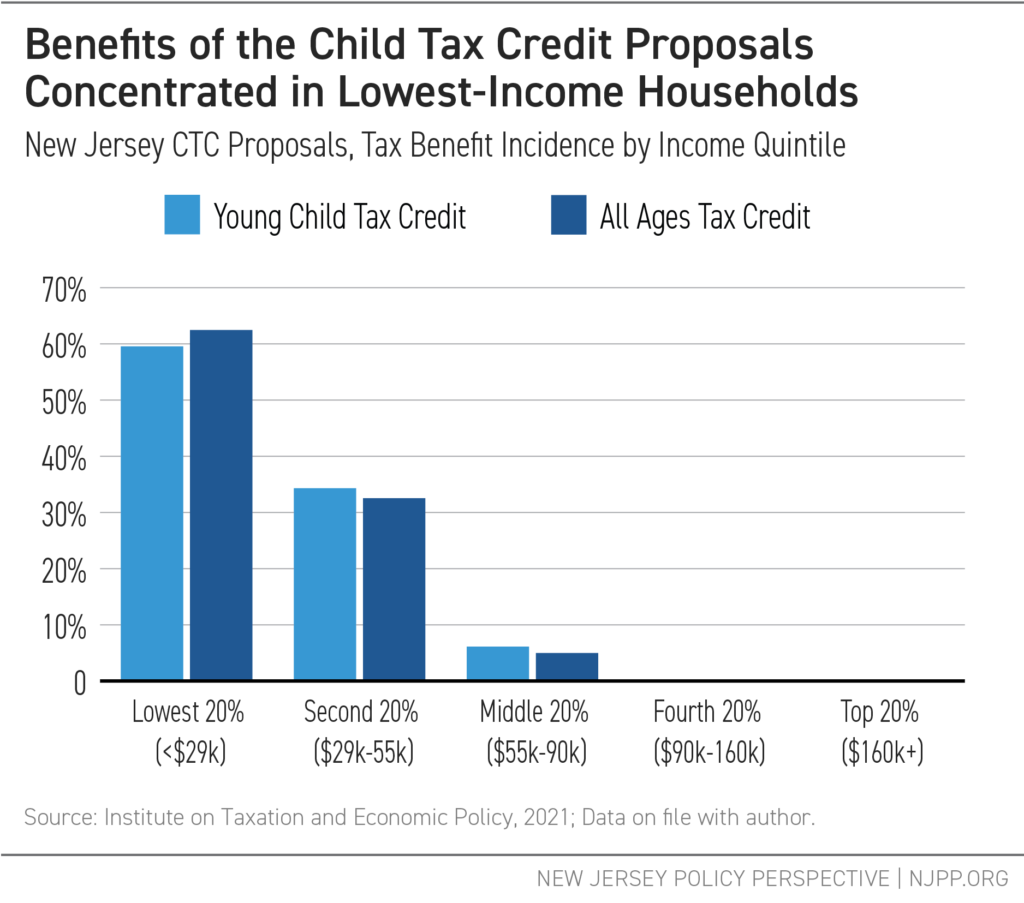

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

Nj Property Tax Relief Program Updates Access Wealth

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

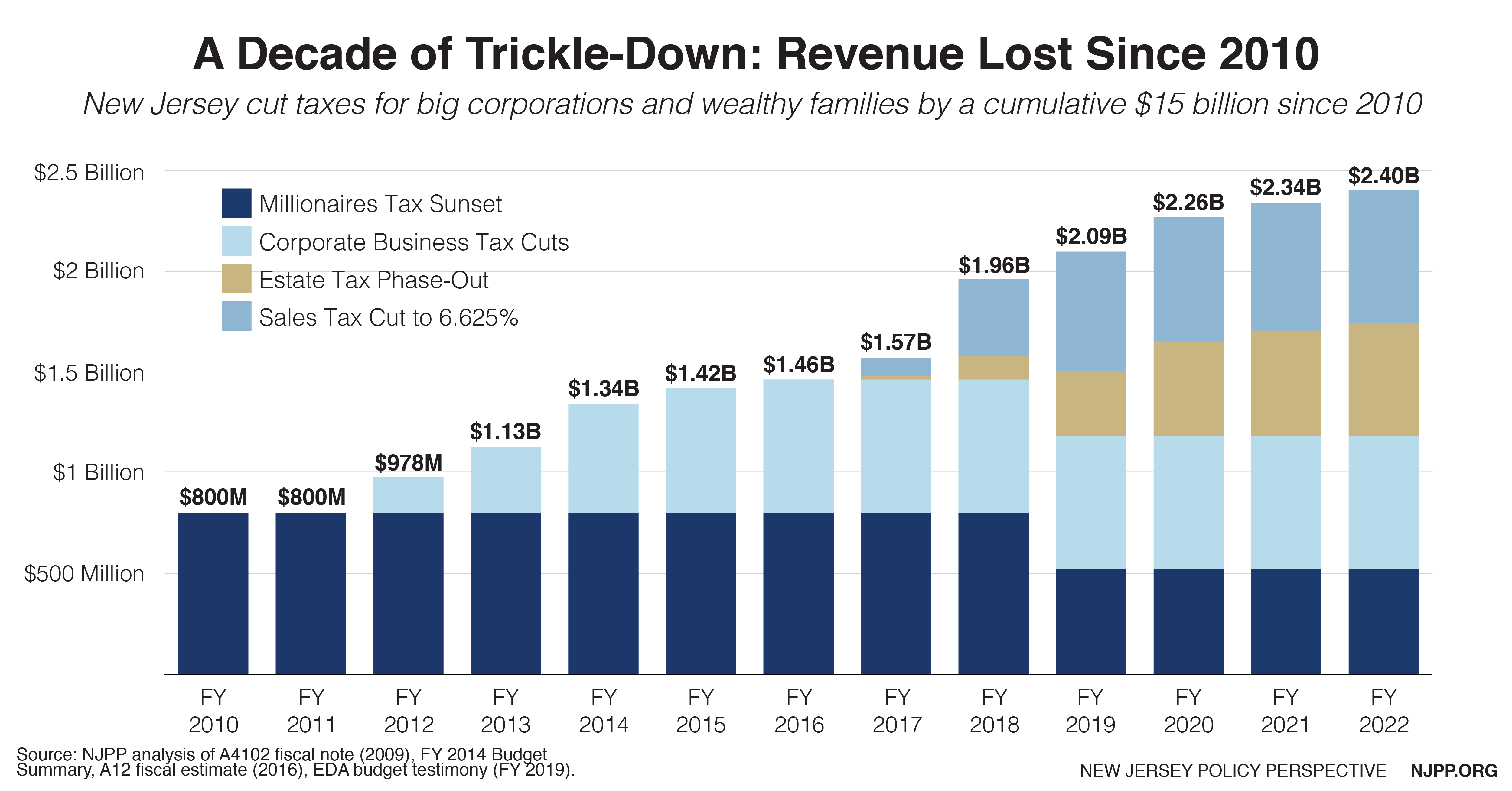

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective